Envisioning a Future-Forward Healthcare Ecosystem and its Pathway: A Thought Leadership Roundtable

Introduction

The COVID-19 pandemic has disrupted healthcare, causing seismic shifts in care delivery, a strain on healthcare organizations’ resources and uncertainty about near- and long-term growth. These disruptions also have provided an unheralded opportunity to innovate, adapt business models and reimagine a healthcare ecosystem that expands beyond the hospital walls to home and outpatient settings via a plethora of interconnected devices. The senior digital healthcare executives who lead technology transformation in their organizations will play a key role in shaping the future of integrated healthcare. Philips Healthcare invited five members of the College of Healthcare Information Management Executives (CHIME) to share their vision of a future-forward healthcare ecosystem and the path to it. CHIME President and CEO Russell Branzell moderated the discussion. Present were:

- Jim Boyer, CIO, Rush Memorial Hospital. Rush Memorial Hospital is a critical access facility in Rushville, Ind.

- Zafar Chaudry, MD, Senior Vice President and CIO, Seattle Children’s Hospital. Seattle Children’s serves as the pediatric and adolescent medical center for the states of Washington, Alaska, Montana and Idaho.

- Edward Cuellar, CIO, Methodist Healthcare System. Based in San Antonio, the Methodist Healthcare System network includes nine acute care facilities that serve patients in the South Texas region.

- Donna Roach, CIO, University of Utah Health. University of Utah Health is an academic healthcare system based in Salt Lake City with five hospitals and 12 community clinics.

- David Young, Service Area CIO, Kaiser Permanente. Kaiser Permanente is one of the nation’s largest not-for-profit health plans, serving more than 12 million members through Permanente Medical Groups, with 39 hospitals and 715 medical offices.

The Pandemic’s Fallout

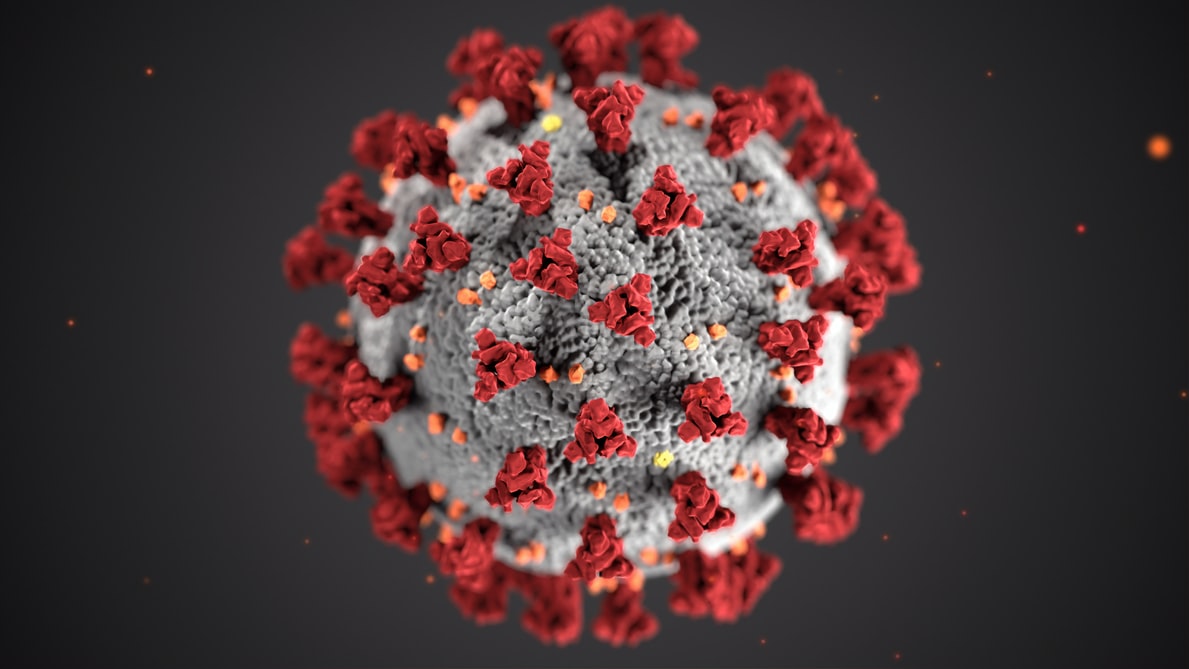

The COVID-19 pandemic has rocked every industrial sector, but healthcare may be the most dynamically impacted. As the guardians of public health, hospitals and healthcare organizations provided the essential services to care for the severely sick in their facilities during surges and, through the rapid rollout of telehealth, remotely monitor patients with milder symptoms. The initial need to cancel elective procedures and routine visits cut off a major source of revenue for healthcare organizations, made worse by patients in need of inpatient care who chose to stay away for fear of becoming infected by the SARS CoV-2 virus.

Telehealth has been a bright spot during the crisis, providing a pathway for patients to receive care and, with the relaxation of some federal regulations in the U.S., an avenue for providers to be reimbursed. The digital healthcare executives who lead technology initiatives were able to stand up telehealth platforms, sometimes in days, and flex them to accommodate COVID and non-COVID patients. The use of telehealth skyrocketed in 2020, typically peaking during surges and then dropping post-surge. Even with those declines, usage is well ahead of previous years, according to the 2020 CHIME Digital Health Most Wired survey data.

Although COVID-19 has been devastating in terms of mortality and morbidity, it also has brought unexpected change in the healthcare industry. “Everybody says COVID was such a bad thing,” Boyer said. “It is a bad thing, but it’s a blessing in so many ways for the disruptors in technology; it challenges vendors to think differently about their solutions.” The crisis also focused attention on collaboration within the healthcare industry, Cuellar proposed. “That doesn’t mean we don’t have competition, but collaboration is going to be a key success factor in how we share (patient) information,” he said. “The technology is how we link everything together, how we link patient information together across (settings). There’s just tremendous opportunity out there.”

Learning from Customers

The pandemic-fueled adoption of telehealth has proven that healthcare organizations can be agile. Many organizations now are trying to figure out how to build on their agility, looking for a balance between virtual and in-person care that meets the needs of patients and physicians. Digital technology offers a way to expand into the community, providing care where people live; but it is not likely to supplant bricks-and-mortar facilities that serve the critically ill. To help determine the right ratio, healthcare organizations are seeking feedback from their customers.

Seattle Children’s assembled an advisory panel that includes patients, caregivers and clinicians to assess their preferences. “We’ve experienced a very interesting shift in parents’ thinking,” Chaudry said. “We have shifted to telehealth, and we believe the future for our pediatric system is becoming more of a destination center.” They see their model in the future delivering primary care in communities through technology and reserving the main campus facilities for critical services.

Kaiser Permanente uses surveys to ask members about the quality of their telehealth visits and their technology preferences and queries physicians about their experiences and telehealth’s impact on workflow. “Now, post-COVID, the struggle is determining what is the correct percentage that we want to maintain for normal operations,” Young said. “Is it 40%? Is it 50%? And what does the market want? What do our customers want?” Although Kaiser Permanente has primarily focused on virtual visits in primary care, the organization also is exploring specialties to gauge the right telehealth vs. in-person ratio. “We’re finding that that’s driving our capital plan,” he noted. “It’s changing our facilities and how we’re looking at facility utilization.”

Shift in Partnership Dynamics

The transition to this new model of care will require the technology businesses that sell products and services to be agile, flexible and aligned with their customers as well. Vendors that were supportive and adaptable during the height of healthcare organizations’ COVID-19 challenges are positioned to ascend to long-term strategic partnerships. Roach, who was the vice president of information services at BJC Healthcare in St. Louis through the spring surge, offered as an example a company that found a solution when she asked for a “light” EMR version that would allow four other health systems to connect with BJC Healthcare. Among missteps were sales representatives requesting on-site visits when the IT staff was working remotely. “That makes a big difference in who I partner with in the future,” she said. “When I was having major issues, did you come to the table to really assist, or did you come to the table more to see what was the financial opportunity? To me, that says a lot.”

The early months of the pandemic also revealed which companies were forward thinking, Boyer said. “It’s almost like they had a solution prepared for the crisis, which was fabulous,” he said. Others showed themselves out of touch with the challenges their customers faced. “It does make you rethink the game.”

To translate those positive experiences into a long-term partnership, vendors will need to understand the healthcare organization’s business model and be willing to adapt quickly to meet their customer’s needs. “It really comes down to the level of integration and the level of innovation that they’re willing to tweak their products to better match your business needs,” Cuellar said. They will need to comprehend the complexities and the downstream effect of integration and provide staff training, too. “There are so many pieces and parts to our clinical systems,” Young noted. “If the vendor is fully engaged with us and knows how the system is built, they can join us during an outage and really help troubleshoot the systems. There is both the new implementation and the service and support side of it.”

New Types of Partnerships Needed

The digital health ecosystem will extend beyond the physical constraints of a hospital or medical campus into the community and the homes of patients. It will migrate into the mobile environment, giving patients the freedom to receive care wherever they are. The disruption with COVID-19 pushed this vision forward and the challenges of quickly standing up telehealth services changed the dynamics of how providers and vendors interact. Those experiences set a foundation for a new type of partnership.

In this interconnected consumer-focused ecosystem, healthcare organizations want partners who can reduce the enormous complexity that comes with integrating disparate technologies. They want partners who are equally invested in providing the seamless experience patients, caregivers and physicians want and expect. Forward-looking healthcare organizations are already exploring who might fit that profile with a partnership customized to their needs.

Seattle Children’s is seeking strategic partners to “tell us what the new world looks like,” Chaudry said, and how those partners fit in. “What does the ecosystem of the future look like when you combine your EMR, when you combine your ICU, when you combine remote patient monitoring?” Telehealth revealed the shortcomings of technology in the home, he said, and how challenged healthcare systems are when they try to work in that space. It also put a spotlight on inequities, with some patients lacking resources like laptops and internet service. “Show me how they can integrate all of these different technologies for the benefit of the patient, but at the same time, how can they make it an affordable model that I can ramp up and ramp down when I choose.”

Integrating patient-facing technologies like wearables, apps and other consumer products into the platform will be essential, too. As an entity outside the healthcare system, a partner in this ecosystem will offer “a more holistic look at the pieces of healthcare and where are the gaps,” Cuellar said. The partner also should help integrate data from the myriad of medical devices and consumer devices across the continuum of care. “A partner (who) could step in and help us pull those pieces together would be fantastic.”

To be successful over the long term, the partner will need to be transparent. “I don’t have insight into your strategies that maybe aren’t currently in the market,” Roach said. As the digital health executive who articulates how technology will move the organization forward, she needs to be able to frame a story for her leadership and physicians that focuses on outcomes, not technology. If those outcomes come to fruition, the partners can aim for greater adoption across the organization and in other markets, she proposed.

New Way of Doing Business

The financial blow that COVID-19 dealt to healthcare organizations will have lasting ramifications. But just as the pandemic served as a catalyst for telehealth and other innovations, the financial constraints in its aftermath may open doors for innovative partnership models as well.

According to one analysis, U.S. hospitals lost between $16.3 billion and $17.7 billion a month in revenue and between $4 billion and $5.4 billion in net income from the loss of elective surgeries. Even accounting for financial relief through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the American Hospital Association estimated an overall loss to hospitals and health systems of at least $323 billion by the end of 2020. Millions of Americans lost their jobs and with it their employer-sponsored healthcare insurance. The Centers for Medicare and Medicaid Services reported that Medicaid enrollment increased 6.2% between March and September in 2020. Healthcare organizations will have to adjust to survive.

“One of the things we’ve learned during COVID is the delivery of healthcare is way too expensive in our region,” Chaudry said. “As people have lost their jobs in our region, as more of our patients have gone on Medicaid for help to pay for the care of their children, that’s going to impact our revenue as well.”

To be part of this new digitally connected healthcare ecosystem, hospitals and healthcare systems must find affordable ways to interact with partners. “We don’t have the capital, so how do you think creatively in being able to provide something that doesn’t have that significant investment right up front?” Roach asked. “How do you do it in a creative open model that I can see it, I can touch it, I can feel it, I can show it to my docs, I can show it to my consumers, but not have to go to the board to ask for a $10-15 million investment? … Maybe down the road, it does require that I have an investment, but now I’ve made a better argument and I can actually touch and feel what I’m trying to invest in rather than right up front.”

Cuellar recommended a risk-sharing model. “There’s business risks that I think the partners should be willing to take depending on how well we do,” he proposed. “If we do really well and exceed it, then arguably they should receive some level of reward for that.” Boyer suggested having a proof of concept. “We go buy these expensive cars and we don’t even get to really test drive them within our organizations to see how they run,” he said. Some vendors already offer trials that also include training the staff, he added.

Healthcare organizations like Kaiser that have innovation programs could build partnerships, Young offered. “If we could have a vendor come and say, ‘Here is a complete system that will solve or address a certain problem,’ and we can do a proof of concept or a small pilot with our innovation committee and let our providers get the training and actually try it in a real-world situation. … The vendors helping us to test new things and try new things without a huge financial commitment is spot on.”

Key Learnings and Next Steps

The disruption in healthcare from the COVID-19 pandemic has been devastating in terms of mortality and morbidity, but it also has served as a catalyst for change. Healthcare organizations stood up telehealth and virtual care programs in record time, spurring innovation and tightening their relationships with vendors who supported them. The digital healthcare executives who led telehealth rollouts are now looking forward, envisioning telehealth and virtual care platforms that reach into the home and mobile environments. They are looking for partners who are agile, adaptable and able to reduce complexity to help them navigate this digitally interconnected healthcare ecosystem. Given their financial constraints, they also need partners who are willing to try innovative business models that could reshape the industry going forward.

RETURN TO CHIME MEDIA